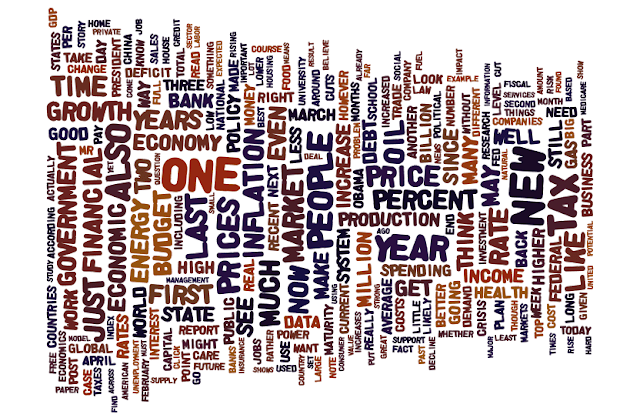

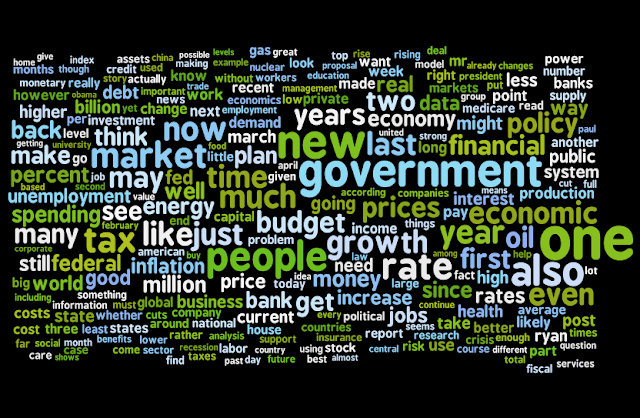

The economics zeitgeist, 24 April 2011

This week's word cloud from the economics blogs. I generate a new one every Sunday, so please subscribe using RSS or the email box on the right and you'll get a message every week with the new cloud. The words moving up and down the chart are listed here . I summarise around four hundred blogs through their RSS feeds. Thanks in particular to the Palgrave Econolog who have an excellent database of economics blogs; I have also added a number of blogs that are not on their list. Contact me if you'd like to make sure yours is included too. I use Wordle to generate the image, the ROME RSS reader to download the RSS feeds, and Java software from Inon to process the data. You can also see the Java version in the Wordle gallery . If anyone would like a copy of the underlying data used to generate these clouds, or if you would like to see a version with consistent colour and typeface to make week-to-week comparison easier, please get in touch.